In a move that will reverberate through the basketball world for years to come, the Grousbeck family, owners of the Boston Celtics, have struck a historic deal that has set a new standard for franchise ownership in the NBA. The deal, which was officially announced earlier this week, marks a turning point not just for the Celtics but for the entire sports industry. As one of the most storied franchises in NBA history, the Celtics have long been under the leadership of Wyc Grousbeck and his family. This latest transaction, however, could reshape the team’s future and alter the trajectory of the franchise for the foreseeable future.

The details of the deal are nothing short of groundbreaking. The Grousbecks have sold a significant portion of their stake in the Celtics to a group of investors, marking the first time in decades that the family has ceded a portion of control. The deal is valued at a reported $2.5 billion, a record-setting price for an NBA franchise, and represents a major financial commitment to the future of the team. However, it is not just the financials that make this deal historic. It’s the way it will impact the Celtics’ operations, their ability to compete in the modern NBA, and the changes it signals for the broader landscape of professional sports ownership.

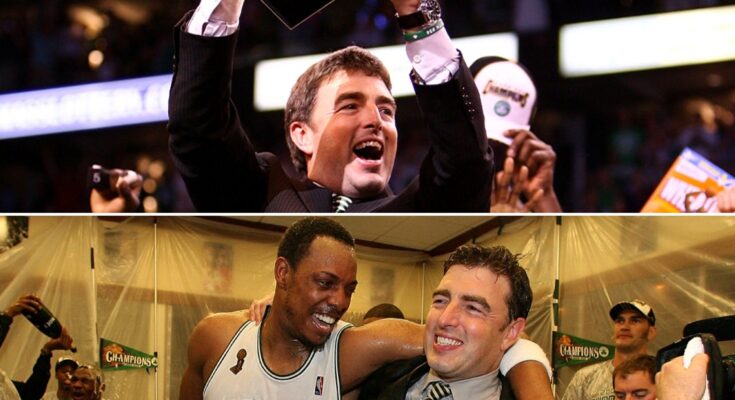

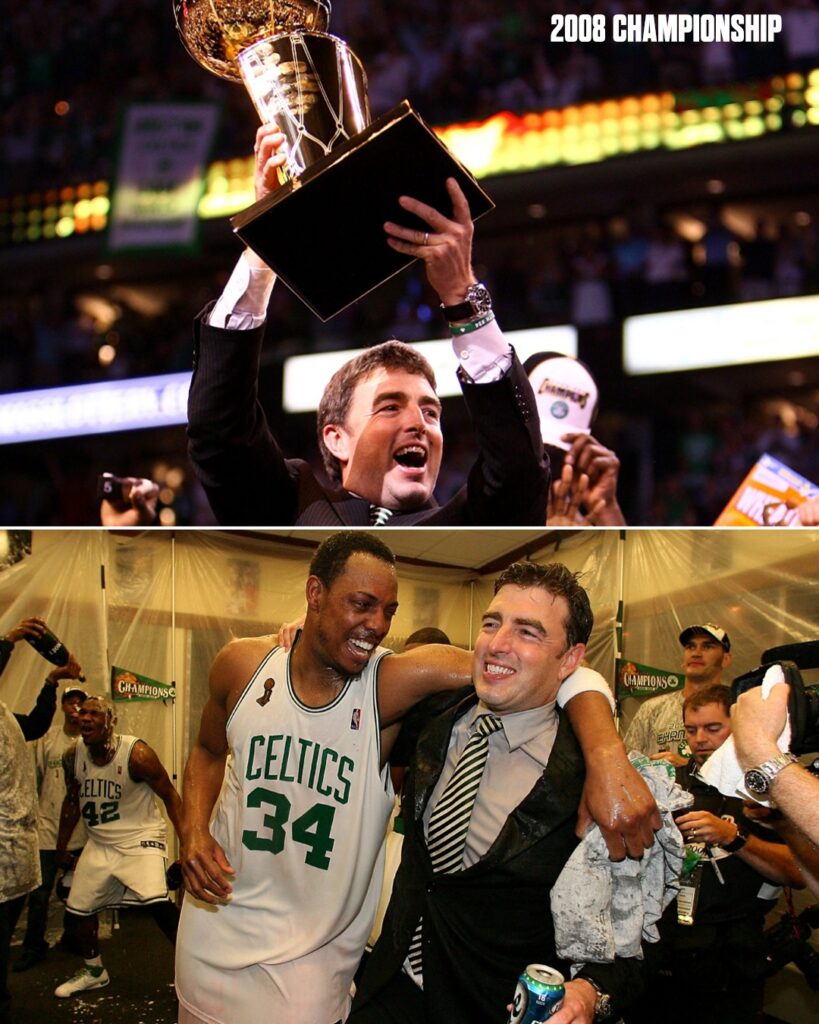

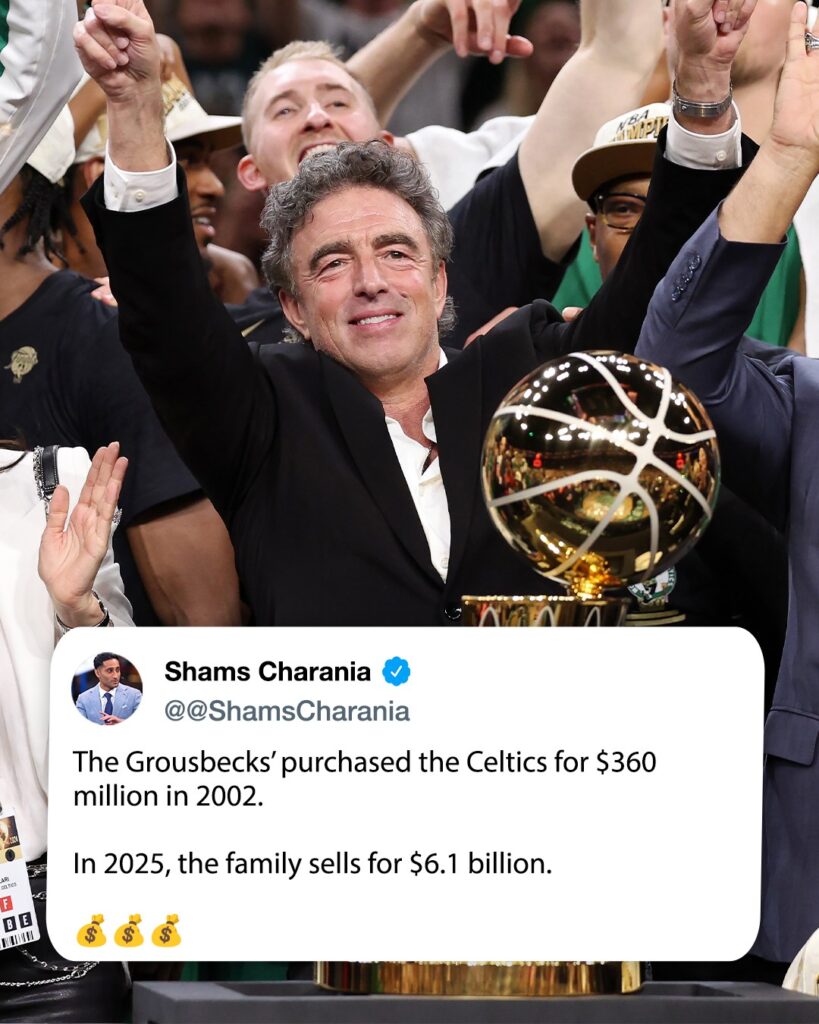

To understand the significance of this deal, one must first consider the Grousbecks’ legacy. Wyc Grousbeck, along with his business partners, purchased the Celtics in 2002 for $360 million, a price that seemed steep at the time but now looks like one of the best investments in sports history. Under the Grousbecks’ stewardship, the Celtics have won an NBA Championship (2008) and made numerous deep playoff runs. More importantly, they have fostered a culture of success, both on and off the court. The Grousbecks have been instrumental in making the Celtics one of the most valuable and prestigious franchises in all of sports. The team’s success, bolstered by icons like Paul Pierce, Kevin Garnett, Ray Allen, and, more recently, Jayson Tatum, has helped solidify the Celtics as one of the marquee teams in the NBA.

Yet, as the NBA continues to evolve, so too does the role of ownership. The modern sports landscape is vastly different from the one that existed when the Grousbecks first acquired the team. The business of sports is growing at an exponential rate, with new revenue streams, expanded media rights deals, and global reach. As a result, the cost of running an NBA team has skyrocketed, with franchises needing more capital than ever before to compete at the highest level. In this environment, the Grousbecks, despite their immense success, found themselves facing new financial realities.

Enter the historic deal. The Grousbecks have partnered with a group of highly influential investors who bring not only financial backing but also business acumen and global influence. The new investors, whose names have not yet been fully disclosed, include a mix of tech moguls, entrepreneurs, and global business leaders, many of whom have interests in media, technology, and international business. The deal will provide the Celtics with the resources they need to invest in new technologies, improve their training facilities, and explore new global markets. With the NBA expanding its reach internationally, the Celtics will be able to leverage their new partners’ expertise in global business to strengthen their brand worldwide.

At the same time, the Grousbecks remain in control of key decision-making for the team. Wyc Grousbeck will continue to serve as the Governor of the Celtics, and his vision for the franchise remains the guiding force. This is a carefully calculated move that allows the Grousbecks to maintain their ownership stake and influence, while also opening the door to new financial resources that can propel the team to greater heights. The deal is a reflection of the Grousbecks’ commitment to the future of the Celtics, as they recognize the importance of adapting to the changing landscape of professional sports ownership.

From a basketball perspective, the deal has far-reaching implications. For one, it signals a renewed commitment to building a championship contender. With the new influx of capital, the Celtics will have more flexibility to make moves in free agency, trade for star players, and invest in player development. The NBA’s salary cap structure makes it difficult for teams to stay competitive without significant financial backing, and the Celtics’ new partnership will give them the resources to build a roster capable of competing with the best in the league.

The deal also places the Celtics in an advantageous position when it comes to player recruitment. NBA players are increasingly interested in the business side of basketball, with many seeking ownership stakes or equity in teams. By aligning with a group of high-profile investors, the Grousbecks have not only bolstered their financial standing but also positioned the Celtics as a franchise that offers more than just an opportunity to play basketball. The team’s commitment to innovation, business expansion, and global growth will likely appeal to players who want to build their brands and legacy in a way that extends beyond the court.

Furthermore, the new partnership will allow the Celtics to explore innovative ways to enhance the fan experience. As technology continues to evolve, sports franchises are looking for ways to connect with their fanbases in new and exciting ways. Virtual reality, augmented reality, and enhanced digital content are becoming essential components of the modern sports experience, and the Celtics will be able to tap into their new partners’ expertise to push the boundaries of what’s possible. Whether it’s through immersive game-day experiences, interactive digital platforms, or expanded access to behind-the-scenes content, the Celtics are poised to set new standards for fan engagement.

The Grousbecks’ historic deal also has broader implications for the NBA as a whole. It signals a shift toward more diversified ownership structures in professional sports. As the cost of owning a franchise continues to rise, more and more teams may seek to partner with investors who can provide the capital and resources necessary to remain competitive. The Celtics’ deal may serve as a model for other teams looking to navigate the challenges of modern sports ownership, creating a ripple effect that could reshape the industry for years to come.

In conclusion, the Grousbecks’ historic deal is a game-changer for the Boston Celtics and the NBA at large. It represents a new era for the Celtics, one where innovation, global expansion, and financial strength will drive the franchise forward. With the support of their new partners, the Grousbecks are well-positioned to continue building a championship-contending team and to solidify the Celtics’ place as one of the most successful and influential franchises in all of sports. This deal is more than just a financial transaction—it’s a statement of intent, one that will define the future of the Celtics for generations to come. 💰